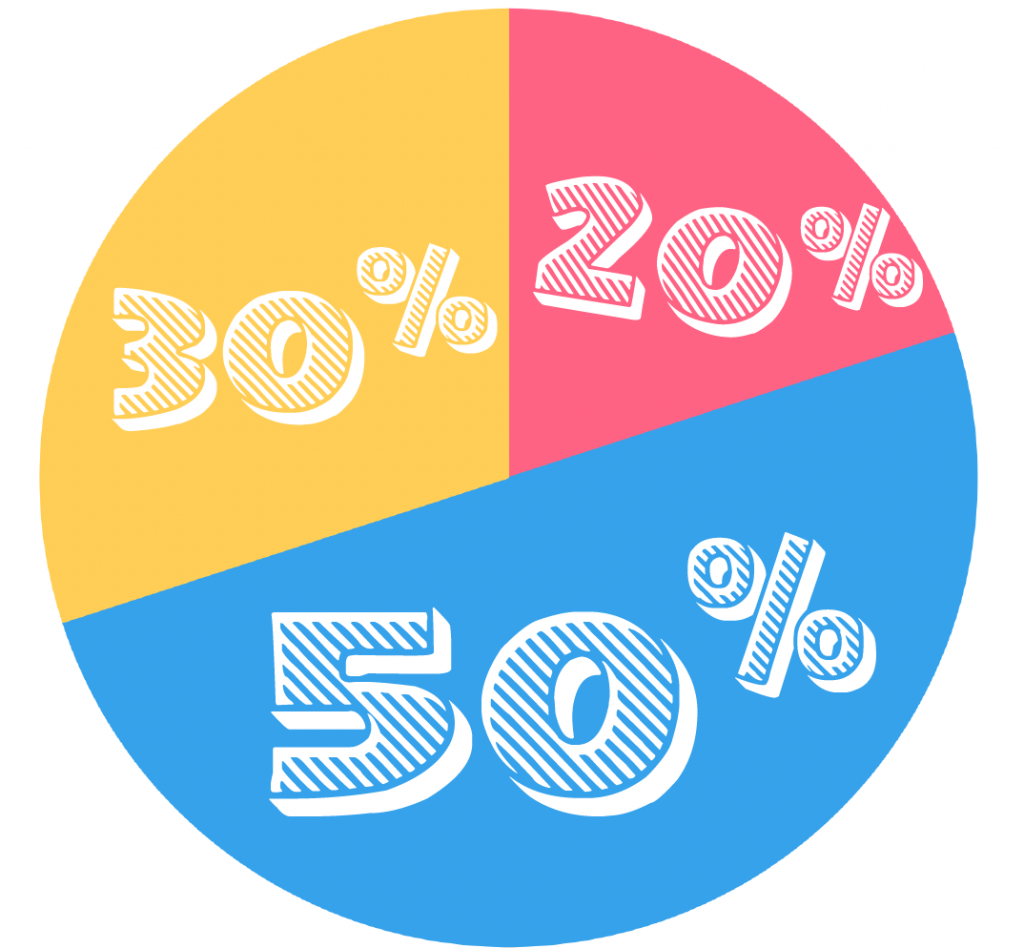

The 50 30 20 Rule: A Simple Budget Approach

- Wealth

- November 3, 2025

Introduction Managing your finances can seem overwhelming, but the 50/30/20 rule offers a straightforward and effective way to budget. This method divides your after-tax income into three main categories: needs, wants, and savings/debt repayment. By following this rule, you can achieve financial balance and set yourself on the path to financial freedom.

1. Allocate 50% to Needs The first category in the 50/30/20 rule is needs, which should take up 50% of your after-tax income. Needs include essential expenses such as:

- Rent or mortgage payments

- Utilities (electricity, water, gas)

- Groceries

- Transportation costs

- Insurance (health, car, home)

By ensuring that only half of your income is dedicated to these necessities, you maintain control over your essential expenses, preventing them from consuming your entire budget.

2. Reserve 30% for Wants Wants encompass non-essential expenses that enhance your lifestyle and enjoyment. These could include:

- Dining out

- Entertainment (movies, concerts)

- Hobbies

- Vacations

- Subscriptions (streaming services, gym memberships)

Setting aside 30% of your income for wants allows you to enjoy life without compromising your financial stability. It ensures that you can indulge in leisure activities while keeping your finances in check.

3. Save 20% for Savings and Debt Repayment The final 20% of your income should go toward savings and debt repayment. This category includes:

- Emergency fund contributions

- Retirement savings

- Investment accounts

- Paying down debt (credit cards, loans)

Prioritizing savings and debt repayment helps build a secure financial future. Whether it’s preparing for emergencies or working toward long-term goals, this 20% is crucial for financial growth.

4. Adjusting the Rule to Fit Your Situation While the 50/30/20 rule is a helpful guideline, it’s essential to adjust it according to your unique financial circumstances. For instance, if you have significant debt, you might allocate more than 20% toward debt repayment and reduce spending on wants. Flexibility within the rule allows it to serve as a personalized tool rather than a rigid framework.

5. Tracking Your Progress Consistent tracking is key to successfully implementing the 50/30/20 rule. Use budgeting tools or apps to monitor your spending and ensure you’re adhering to your plan. Regularly reviewing your budget helps you stay on course and make necessary adjustments.

Conclusion The 50/30/20 rule simplifies budgeting by breaking down your income into three manageable categories. By allocating 50% to needs, 30% to wants, and 20% to savings/debt repayment, you can create a balanced financial plan that supports both your present and future. Start applying this rule today, and take a significant step toward achieving financial freedom.